The carbon tax will increase by 50 per cent on January 1. The tax which was brought in at the beginning of 2017 by the Alberta NDP charged $20 per tonne tax on carbon dioxide emissions. It will go up to $30 per tonne in the new year.

The tax currently adds about 4.5 cents to every litre of gas purchased, after January 1 that will go up to to just over 6 cents. Diesel drivers will also see that increase from about 5 cents to 8 cents on every liter of fuel. Natural Gas will also see a jump from about 50 per cent per gigajoule and propane will also increase from about 5 cents to 8 cents per litre.

Since the 2018 increase will only be half what people experienced last year economists around the province are expecting the effects on individuals to be quite minimum. Calgary Economist Trevor Tombe told CBC News associated costs will mean the tax will appear in the form of higher prices for other goods and services, up to $105 per household in 2018.

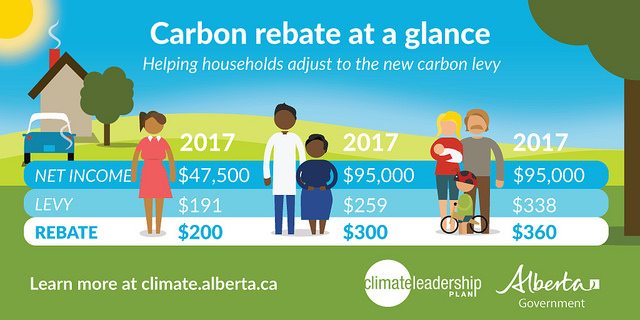

The province will continue with their rebate program where single Albertans who earn less than $47,500/year and families who earn less than $95,000/year will receive a full rebate to offset costs associated with the carbon levy.